Parents upset over GST collection in Chinese Schools

Published by SchoolAdvisor | Feb 14, 2017Educational services provided by all national schools or national type schools and public examination fees are categorised under out of scope supplies. Out of scope means that the educational services offered are not under the GST Act and therefore are not subject to GST. The same applies for the acquisition of goods from suppliers for providing educational purposes, such as multimedia equipment used as a teaching aid.

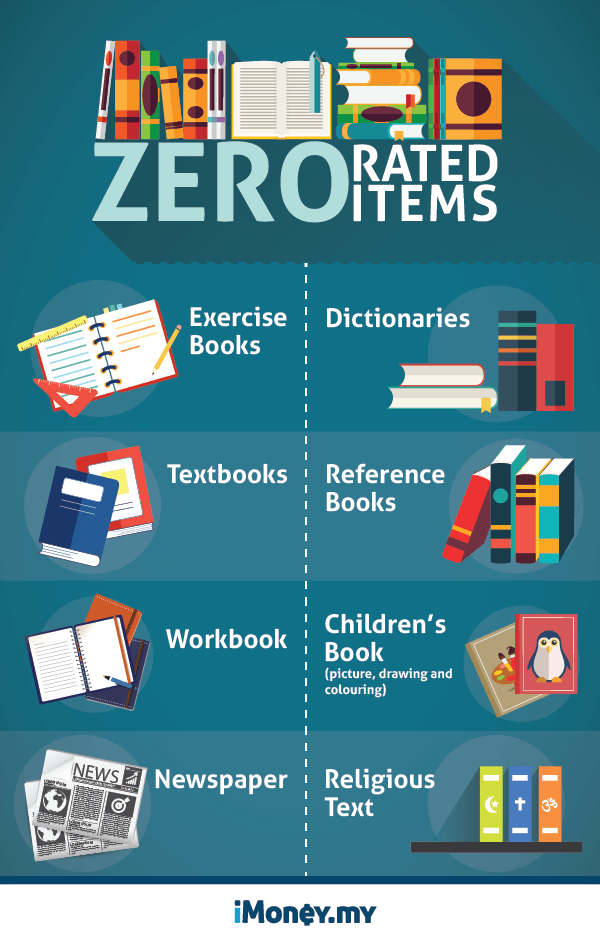

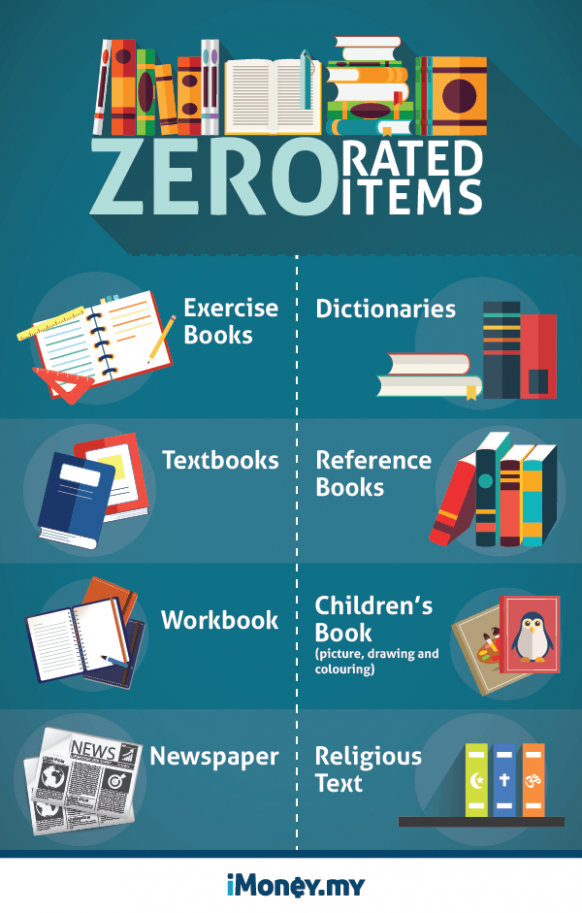

The following is categorised under 0% GST and therefore no GST is charged unto it:

Though education is stated in the exempt supply list, public, private or international schools can expect to see higher operation course, which can trickle down to the parents.There is a special GST relief given to the public educational institution for the goods obtained and used in the premise of the school, but this relief is not applicable for services acquired. GST will be charged by the school’s suppliers for any services acquired such as consultancy, security, computer repairs, maintenance and cleaning services.

Some Chinese schools are reportedly charging GST to parents

A group of parents are up in arms over what they claim to be unlawful collection of the Goods and Services Tax (GST) in some Chinese schools. The parents, through Persatuan Jaringan Ibu Bapa Pencinta Pendidikan Bahasa Zhong Hua, claimed that the latest case was at SJK(C) Tun Tan Siew Sin in Subang Jaya.

The association’s adviser, Edward Neoh Chuan Tat, speaking on behalf of the parents, said it had received a letter from the school dated Jan 23 informing parents that they needed to pay RM14 for Bahasa Malaysia extra classes and RM22 for teaching and learning courseware, including six per cent GST.

In May 2015, a complaint on three schools were lodged with the Customs Department. The department raided two of the schools and the money was given back to parents. The schools were SJK(C) Puay Chai 2 in Bandar Utama, SJK(C) Lai Meng and SJK(C) Yuk Chai.

According to the Facebook group, SJK (C) Fees Monitoring Forum, among the methods used for such collection were getting schools or parent-teacher associations (PTA) to collect GST fees, using a school’s letterhead to issue letters on GST collection and not stating the fee breakdown in school notices.

Edward Neoh, in efforts to clarify the issue spoke to a customs officer and they confirmed that GST cannot be imposed at schools for school-related activities. “The school and PTA are not GST-registered companies, so they cannot collect GST fees,” said Neoh, a 50-year-old businessman with two school-going children.

“One company has increased fees for computer classes and issued cards for monthly fee collection claiming that it has been approved by the state education department.”Another parent, Lim Jenn Shiah, said “Chinese schools will become a ‘gold mine’ for vendors, as these parties will use the school or PTA to collect money.

“Parents may feel that it’s not a problem paying additional fees if the school activities are endorsed by the PTA, but a school is a place that is exempted from GST.” Neoh said the group decided to check on the issue with the Customs Department, which is the sole authority on GST, and did not refer to the Education Ministry or respective schools.

Recent Articles

- Leannie Liew’s Journey at Cempaka International School: Pushing Boundaries and Discovering Potential

- VOX ISKL: Leveraging Language Learning

- From elc to Harvard: Thamini Vijeyasingam’s Journey to Ivy League Excellence

- BNEY Bangsar: A Day with Police Officers, Our Local Heroes.

- From GIS to Bank of America: How Eisha Izaddeen’s Education Prepared Her for Success

Login with Google

Login with Google